In April 2024, Dubsado rolled out its new Dubsado payments feature powered by Stripe. I’m really excited about some of the additional features that Dubsado is rolling out (hopefully soon) and I know my Done for You Dubsado clients will be too since one of them is something nearly EVERY client asks me about.

I put together this post about this new feature and rolling up all of the Q&A from Dubsado.

If you’ve been wondering if you should switch or how this will be different than Stripe, keep reading.

Here’s what we’re covering in this post

What is Dubsado Payments Powered by Stripe?

How is it Different than the Stripe Payment Processor I Had Before?

Where is Dubsado Payments Being Offered?

What Will the Payment Processing Fees Be?

Will the Speed of Payouts be Different than my Current Stripe payouts?

What is the Difference Between Dubsado Payments, Stripe, Square, or PayPal?

How Do I Switch to Dubsado Payments

How Will My Checkout Experience Change?

What Payment Options Will Be Offered Going Forward?

Changes You Might Need to Make to Your Processes

What is Dubsado Payments Powered by Stripe?

It’s basically the same as Stripe, but there are a few changes from the legacy Stripe payment processor.

How is it Different than the Stripe Payment Processor I Had Before?

Depending on how Stripe moves your account to Dubsado Payments (more on that below) you might have a new Stripe account called Dubsado Payments. (I haven’t seen that in my account yet, so more to follow on that.)

Where is Dubsado Payments Being Offered?

Currently its being rolled out in the following countries: Australia, Austria, Belgium, Bulgaria, Canada, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Mexico, Netherlands, New Zealand, Norway, Poland, Portugal, Romania, Singapore, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Arab Emirates, United Kingdom, United States.

Check this link for the most up-to-date list of countries.

What Will the Payment Processing Fees Be?

The payment processing fees will be the same as (or lower than) Stripe’s fees. Read their fee information HERE.

Will the Speed of Payouts be Different than my Current Stripe Payouts?

Nope.

The payout processing speeds will stay the same as Stripe. Stripe payouts will be based on what Stripe currently offers in your location and the current payout schedule in your account settings. Read more info HERE. You have the option of choosing instant payout in Stripe, but be aware that it’ll cost more.

What is the Difference Between Dubsado Payments, Stripe, Square, or PayPal?

All three payment processors allow you to pay by credit card or debit card.

PayPal: doesn’t allow ACH. Also, if the client mis-enters their email address, Dubsado can’t help you correct the email and receive the payment. It’s also not compatible with Dubsado automatic payments (autopay.)

Square: Ony allows debit and credit card payments. (No ACH transactions) and your clients can only use credit and debit cards to enroll in autopay.

Stripe and Dubsado payments: allow ACH transactions (at a much lower fee), credit card, and debit card payments.

Dubsado Payments: is the only one that allows ACH payments, and the only one that allows autopay for both ACH payments and debit/credit cards.

You can still offer Paypal payments to your client if you’re using Dubsado Payments.

What Features Does it Offer?

An easier refund process

If you’re using Dubsado Payments, you can issue refunds directly from Dubsado. (Instead of refunding in Dubsado then going to your external payment processor account, finding the transaction,a and initiating the refund there.

Refunds will show on your Dubsao invoice automatically if you initiate them in Dubsado.

You can use Autopay with ACH transactions to save on processing fees

You couldn’t use ACH transactions and Dubsado automatic payments (autpay) in the past. With Dubsado’s new payment processor, you can!

Credit Card Surcharging to Clients Who Pay with Credit Cards

You used to have few choices when it came to charging clients for credit card fees. You could raise your rates to cover them across the board, not accept credit cards (and lose prospective business) or just eat the expense.

Now with Dubsado’s new Payments powered by Stripe, you can add credit card surcharges of up to 3% in the United States and 2.4% in Canada. This allows you to reduce the burden of credit card processing fees for yourself by passing them on to your clients who pay with credit cards. Note: you can’t charge for using debit cards, however.

Not Everyone Has Access to This Feature

It’s available only in the US and Canada. Plus, certain states don’t allow it, so if your business is located in Connecticut, Maine, Massachusetts, New York, or Puerto Rico, you can’t use it either.

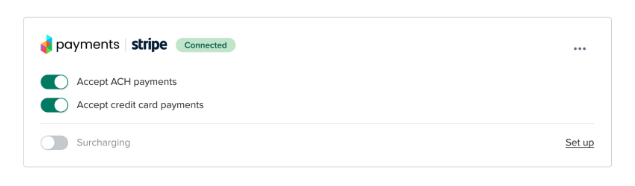

How Can I Add Credit Card Surcharging in Dubsado?

Head to the settings gear, choose Payments and Invoices, and click the Set up link next to Surcharging. Be sure to walk through all of the screens and add the proper disclosure to the first place that you talk about the types of payments that you allow. (For most of my clients it’s the invoice or proposal.)

Higher weekly ACH transaction limits

You can charge up to $20,000 in ACH transactions per week. (If you already negotiated a higher limit with Stripe, you’ll retain your higher amount.) You can reach out to Dubsado’s customer care team to request additional limit increases.

How Do I Switch to Dubsado Payments

If You Already Use Stripe

If you’re already using Stripe, you might be eligible for an automatic rollover to the new Dubsado payment processor. However, Stripe makes the call and will do one of three things.

Automatically roll your current Stripe account to a Dubsado payments account:

This won’t change any additional connections that you have to Stripe. (If you currently use Stripe with more than one service ex. Kajabi, ConvertKit, etc. Then you might be aware that Stripe creates a separate account for each connection.)

Migration:

Stripe will migrate your regular Stripe account (the one that’s connected to Dubsado) to a Dubsado Payments account for you. You won’t need to take any additional action unless Stripe contacts you for updated information or a data review.

Things to know: Account migration won’t cause any disruptions to open invoices or autopay. After account migration, you can access both the old Stripe account and the new Dubsado Payments account through your Stripe Dashboard. Your login info will be the same for both accounts.

Re-onboard:

You might need to create a new Stripe account with a different email.

If You’re Not Currently Using Stripe

If you’re not currently using Stripe, you can find instructions to switch HERE. Here’s a quick step-by-step overview of the process.

Step 1. Click the settings gear in the upper right corner and select Payments and Invoices. Then select your country and currency (if you’ve never connected to a payment processor before.)

Step 2. Click ‘Get started’ next to Dubsado Payments.

Step 3. Complete Stripe’s onboarding process.

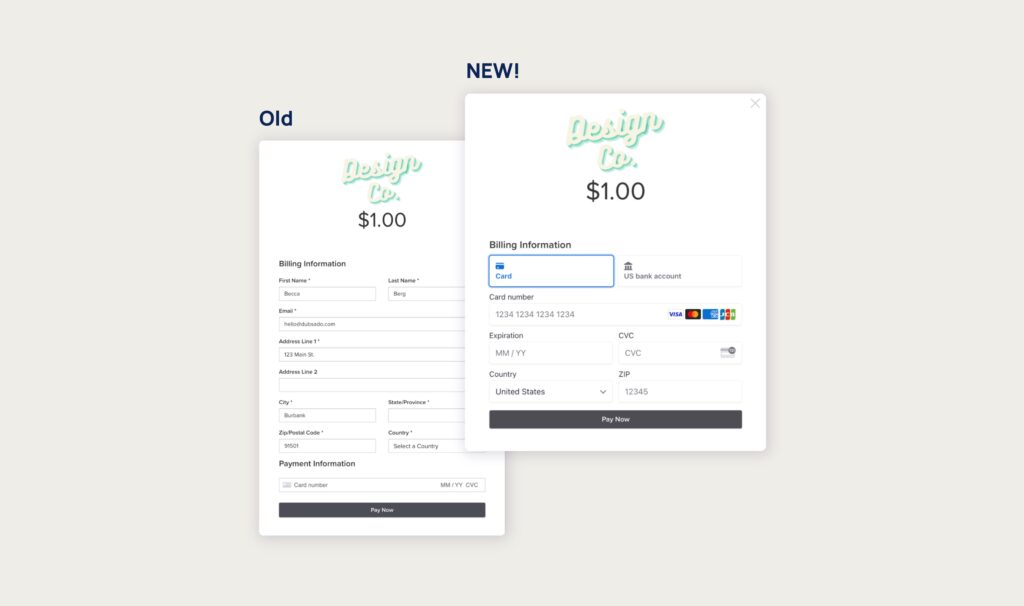

How Will My Checkout Experience Change with Dubsado Payments Powered by Stripe?

When clients check out, they’ll now see the Stripe checkout screen instead of Dubsado’s checkout screen.

New Features in the Works

These are the things that I’m really psyched about! I’ve been wishing for all of these for a long time.

Additional payment methods including Google Pay, Apple Pay, local payment methods like BACs, BECs, PADs, and SEPA, and even in-person payment portals. (So you won’t have to manually enter the payment if someone wants to pay in person with a credit card.)

What Payment Options Will Be Offered Going Forward?

You’ll still be able to use Stripe (as Dubsado Payments), Square, and PayPal by itself or in combination with Stripe and Square.

Changes You Might Need to Make to Your Processes

If you were previously manually changing certain customers to have only ACH or a certain processor, you won’t be able to do that anymore

You can no longer make payment types required on a per-customer basis.

Ex. Only allowing a customer with a higher priced invoice to pay with ACH while your setting for everyone else is credit card and ACH.

This is a Stripe requirement for billing transparency. My recommendation: Choose the setting to apply to your account that fits MOST of your clients. Also, keep in mind that Dubsado is working on rolling out surcharging for credit card processing fees in the not-too-distant future.

The fee description will change

This is more of an FYI than anything else. If you go into Stripe to look at the transaction record, what used to be called Stripe processing fees is now called Dubsado application fee.

Want Me to Help You Connect Dubsado Payments Powered by Stripe and Get More Out of Your Dubsado?

Sometimes setting up Dubsado and figuring out how to use all of these features can be a lot! If you’re ready to start using all of the amazing features in Dubsado and stop doing so many things manually in your business, book a free discovery call with me to learn how I can help.

+ view comments . . .