Dubsado has recently introduced Affirm as a new payment option. While this addition offers a fresh approach to handling transactions, it also comes with its own set of considerations. With a standard 6% transaction fee—currently reduced to a 3% introductory rate—business owners must weigh the benefits against the costs. If you decide it’s not for you, you’ll want to take action right away to avoid paying hefty transaction fees because it’s being rolled out on all eligible accounts. (More on that in a minute.)

In this blog post, we’ll explore what Affirm is, how it integrates with Dubsado, and whether it might be the right fit for your business.

What is Affirm?

Affirm is a company that provides installment loans to consumers at check out. Essentially, it allows customers to split their purchase into manageable monthly payments, making it easier for them to afford larger expenses. This can be particularly appealing for businesses that offer high-ticket items or services, as it may encourage customers to commit to purchases they might otherwise defer.

But how does this align with the needs of your business, and what are the potential implications?

Understanding the Transaction Fees

One of the most critical factors to consider with Affirm is the transaction fee. The standard rate is a hefty 6%, (YIKES!) which can significantly impact your profit margins. However, Dubsado is currently offering an introductory rate of 3%, which makes it a little more palatable for early adopters. It’s important to calculate how these fees will affect your bottom line and to consider whether the potential increase in sales volume can offset the additional costs.

How Affirm Integrates with Dubsado

Affirm’s integration with Dubsado is designed to be seamless, automatically enabling the payment option on all eligible accounts. If you’ve ever purchased with Affirm or Klarna, then you probably know how it works.

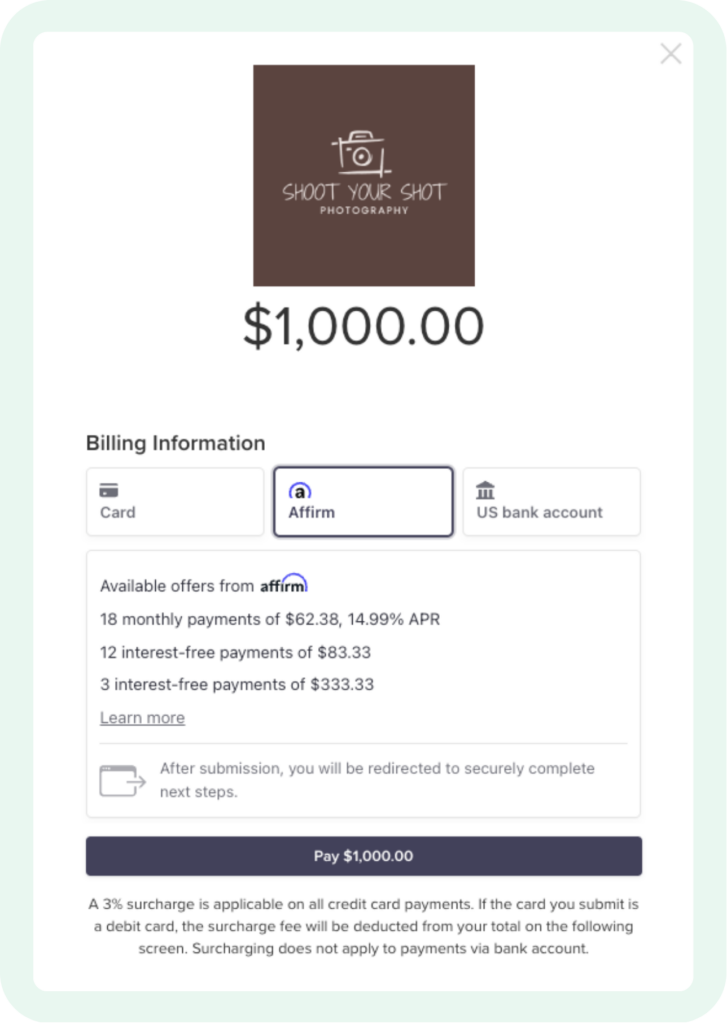

When your client clicks “pay now” on the invoice total at checkout, they can select Affirm as their payment method. From there, they choose a payment plan that works for them, and put in their payment information. You receive the full payment upfront. Affirm then manages the installment payments directly with the customer. This process not only simplifies transactions for your clients but also ensures you get paid in full without delay. (After the transaction fee comes out of course.)

Eligibility and Qualified Business Types

Not all businesses will be eligible to use Affirm through Dubsado. The service is only available to certain business types. Before diving in, it’s essential to verify whether your business meets the eligibility requirements and to understand the potential advantages and limitations specific to your industry. In case you’re wondering this is decided based on the industry you chose when you set up your Stripe account.

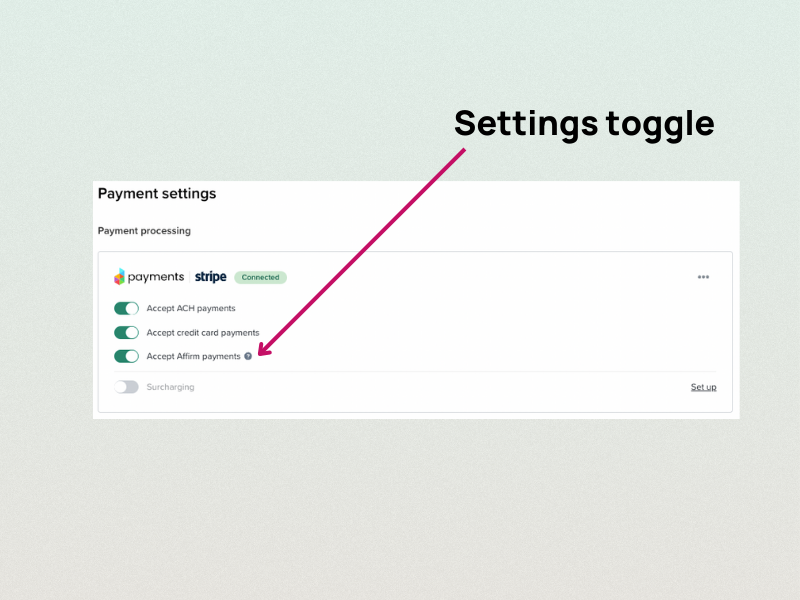

Managing Affirm: Turning It Off

Affirm is automatically enabled for eligible accounts. You have the option to turn it off if it’s not the right fit for your business. It’s pretty easy to do: simply click the settings gear in Dubsado, navigate to Payments and Invoices, and toggle off the Affirm option.

What About Refunds?

If you need to offer a full or partial refund you have up to 120 days after purchase to do it. Once a refund is initiated, the customer’s installment plan is paused and any payments made are refunded to the customer. Affirm does not refund any interest paid by the customer AND they don’t return the transaction fees to you either. (This is the same with regular Stripe transactions too.)

Can I Use Surcharging and Affirm at the Same Time?

Yes, you can have both enables, but if the client opts to pay using Affirm, you can’t charge them for credit card fees. (In other words, you’re still paying the 6%.)

Pros and Cons of Offering Affirm

Offering Affirm as a payment option can be a double-edged sword. On the one hand, it provides customers with more flexibility and can lead to increased sales. (Affirm estimates a 21% boost to conversion rates over traditional payment methods.) On the other hand, the transaction fees can eat into profits, and not all customers may be comfortable with financing options. Weighing these pros and cons is crucial for making an informed decision about whether to adopt Affirm.

Making the Decision: Is Affirm Right for You?

Ultimately, the decision to offer Affirm through Dubsado depends on your business model, customer base, and financial goals. You could consider running a trial during the introductory rate to gauge customer interest and assess the impact on your sales and profit margins. Engage with your customers to understand their payment preferences and gather feedback on the addition of Affirm. This way you can get a little better idea of the costs vs the benefits of using Affirm.

Is Dubsado’s New Payment Option For You?

Dubsado’s addition of Affirm as a payment option presents both opportunities and challenges for business owners. While the potential for increased sales is enticing, the associated transaction fees are definitely something to keep in mind.

I’d love to hear from you. Are you going to use Affirm in your business? Why or why not. Comment below or send me a DM on Instagram.

+ view comments . . .